Recently, domestic veteran home appliance company Konka announced the establishment of the semiconductor technology business unit, officially entered the semiconductor industry. Zhou Bin, president of Konka Group, said that it will take 5-10 years to become one of the top 10 semiconductor companies in China and strive to become the top 10 semiconductor companies in China. The annual revenue is expected to exceed 10 billion yuan. Earlier, Gree also disclosed in the 2017 financial report that "to enter the semiconductor integrated circuit industry." Dong Mingzhu, chairman of Zhuhai Gree Electric Co., Ltd., said in an interview with CCTV Financial Channel recently: "Even if you invest 50 billion yuan, Gree will also succeed in chip research." Gree and Konka have entered the semiconductor industry, what is their intention? When investing heavily, they unanimously release their words, and where does their confidence come from?

Positioning application-level directions have different emphasis. Integrated circuits are distinguished by dimensions such as functional structure, manufacturing process, application area and use, and can be divided into many different types. If it is divided from the perspective of the industry chain, most of the semiconductor businesses currently deployed by Gree and Konka are related to IC design and packaging processes. From the information disclosed by the two companies, it can be seen that the semiconductor business areas they are expanding in the future are not the same, and each has its own focus. In 2017, Gree announced the establishment of the microelectronics division and plans to build its own chips. It is reported that Gree Microelectronics Department is affiliated to Gree Communication Technology Research Institute. It has a complete R&D team covering the entire chip design process, such as digital front end, digital back end, analog design, layout design, hardware design, software design and power device design. For air-conditioning products, a variety of chips are involved, including external chips, internal chips, compressor chips, and the like. According to relevant media reports, Gree Electric has begun to do IGBT (insulated gate bipolar transistor, is a semiconductor power device, the AC frequency conversion technology of air conditioning needs such components to support) in the early years, for the main chip of the air conditioner Designs have also been made, taking the form of outsourcing processing for parts that cannot be designed. According to industry insiders, the current chip of Gree Electric is mainly designed to meet the purpose of self-use. A few days ago, Li Hongwei, vice president of Konka Group, also revealed the main development direction of Konka's semiconductor business in the interview. He said: "Storage and IoT chips are the two major directions for Konka's business in the future. First, the sales of Konka terminals are large, and the market will become larger and larger in the future. The storage business is worth doing in a down-to-earth manner. In addition, the future IoT chips Technology will bring new development opportunities. The key layout of this technology is very important for a company in both real and strategic sense. In addition, he also said: "Semiconductor is not a one-off industry, The upstream industry chain also needs attention. Konka will continue to invest in production lines, design and packaging. Meanwhile, Li Hongyi also made it clear that Konka will not lay out semiconductor wafer related business for the time being.

Mastering the core competitiveness during the critical period of transformation and upgrading "Gree, mastering core technology", this is Gree's classic slogan, but Gree did not seem to pay much attention to upstream chip technology. According to industry insiders, in the early years, Dong Mingzhu was asked "why not to do chips" in an interview. Dong Mingzhu said frankly: "The chip is very cheap, only a few dollars." Today, Dong Mingzhu released "50 billion yuan words" "It must also be aware of the dangers of the upstream supply chain being subject to people, taking the lessons of the "ZTE event" and making coping strategies. According to professionals, China has become the world's largest demand market for IGBTs, but it still relies mainly on imports. In addition, the market supply of ADC (analog-digital hybrid) control chip is basically in the hands of companies such as the United States and Japan, and this chip is becoming more and more important, and it is applied to almost all emerging fields of high-speed development. In the future, China's market consumption will accelerate, and home appliances such as air conditioners will also be oriented toward high-end and intelligent development. Enterprises without underlying technical support will lose at the starting line. Gree's entry into the semiconductor industry can be understood as preparing for the "next decade." Compared with Gree's “learning lessonsâ€, Konka's expansion of the semiconductor business is the epitome of the overall strategic transformation of Konka Group. At a press conference held recently, Konka announced that it will restructure its business structure into four business groups and two major technology divisions (including the semiconductor technology division). In the future, it will focus on “building innovation driven by technological innovation. The platform company is the core positioning. Refining the chip business, Li Hongwei said in an interview with the media: "The current chip core technology is still dominant abroad. But the Internet of Things is a brand new technology field, which gives many companies the opportunity to overtake the corner. In the future, Konka also Will take appropriate cooperation or mergers and acquisitions, acquisitions and other means to expand the influence and technical strength in the semiconductor field." Konka, as a domestic old-fashioned home appliance company, has caught up with the market dividend brought about by the rapid growth of China's economy, but is currently facing difficulties. During the transition period, Konka was still at a loss until 2015. In today's consumer upgrades and the critical period of strategic deployment of major companies, Konka is not unreasonable as a breakthrough in the emerging field of semiconductors.

Challenge the hidden dangers and coexist with the risk of being left behind. "From the perspective of state responsibility, I am in favor of the home appliance enterprises to do chips; but from the perspective of business operations, I have a negative attitude." Recently, the appliance industry observer Liu Buchen said in an interview: "Chip and even the semiconductor industry needs a lot of capital investment. At present, there is no absolute strength of a Chinese home appliance company." It can be seen that Chinese home appliance companies and other industry giants have announced that they have successfully entered the semiconductor industry and attracted the attention of the public. It is the determination of Chinese companies to build China's "core", but at the same time some potential challenges and hidden dangers can not be ignored. First of all, from the perspective of business management, the layout of new industries means continuous, large-scale investment, and will not achieve export earnings in the short term, which requires the company to have strong integration, digestion and healthy financial support. If you press the strength of integration, and look at the financial situation alone, it will pose a huge challenge to the home appliance companies that are eager to try. Taking Konka as an example, according to its 2017 annual report, during the reporting period, the Group achieved a total operating income of 31.2 billion yuan and a profit of 5 billion yuan (a large part comes from the sale of real estate). This is the best annual report of Konka in recent years, but it seems that it is not enough to support its development goals in the integrated circuit industry. Zhao Weiguo, chairman of the domestic integrated circuit leading company, Ziguang Group, publicly stated: "To be an integrated circuit, if you want to enter the first group, you need to invest a large amount of capital. If you don't invest $10 billion a year, you can't enter the first place. The group's "burning money" capability in the integrated circuit industry is evident. Comparing the financial data of Konka and Gree in recent years, we can see that their semiconductor business development still has a long way to go. Of course, learning to "avoid the light and light", in the "specialization" field to play the characteristics of Chinese companies, or will open up new ways. Dong Min, vice president of Aowei Cloud Network, told the reporter: "The global economy is gradually achieving integration, but for the country and the industry, it still needs to be aware of the crisis. Policy formulation and implementation should be more pragmatic, and guard against speculative thinking to diversify resources in the physical field. For the development of home appliances or cross-border enterprises, it is not necessary to focus on the core of integrated circuits, to avoid heavy assets, and to guard against low-end overcapacity. In addition, 2017 Konka Financial Report also shows that color TV business is all year round. The company achieved revenue of 11.995 billion yuan and a gross profit margin of 16.11%, which contributed 19.32 billion yuan of profits to the group. It is still the pillar industry for Konka to survive. Gree's dependence on the main business is even more obvious. In 2017, Gree air-conditioning business accounted for more than 80% of the company's revenue share, with annual revenue of 123.4 billion yuan, a year-on-year increase of 40%. In the future, Gree and Konka need to be vigilant. While fully expanding their new business, how to avoid the main business from being dragged down and ensure the health of financial data. This is also a real problem left for Gree and Konka.

Related reading: Supply and demand status and competition analysis of global and Chinese semiconductor wafer industry in 2018 Â Â Â Â Silicon wafers are the raw materials for the fabrication of semiconductor silicon devices for the fabrication of high-power rectifiers, high-power transistors, diodes, switching devices, etc. Subsequent product integrated circuits and semiconductor discrete devices have been widely used in various fields. As an important semiconductor material, monocrystalline silicon has been widely used in photoelectric conversion and conventional semiconductor devices. An electrically driven light source, such as a discharge lamp, a fluorescent lamp or a cathode ray screen, a light emitting diode, or the like. From an information point of view, technologies and components such as light emission, amplification, modulation, processing, storage, measurement, and display can be utilized to form an optoelectronic system with specific functions. For example, fiber-optic communication can achieve the purpose of rapid and large-capacity information transmission. It has greatly improved the level of similar technology. Silicon wafers of various sizes and sizes are widely used in the semiconductor manufacturing industry, usually including 4, 5, 6, 8 and 12 inches. Their basic specifications are shown in the following table:

Figure 1: Basic semiconductor wafers specification  Source: Forward-looking Industrial Research Institute to organize the global silicon market competition status: 70% of the Big Three

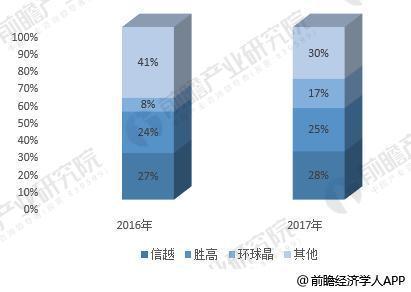

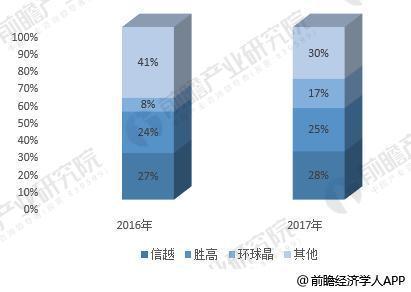

Source: Forward-looking Industrial Research Institute to organize the global silicon market competition status: 70% of the Big Three According to the Prospective Industry Research Institute's "2018-2023 Semiconductor Wafer, Epitaxial Film Industry Market Forecast and Investment Strategic Planning Analysis Report" According to the data, in the current global silicon market, Japan's Shin-Etsu, SUMCO, and Taiwan's Global Wafer have occupied 70% of the market share of silicon wafers, and the concentration is on the rise.

Figure 2: Global wafer market pattern for 2016-2017  Source: Prospective Industry Research Institute 's current global 12-inch wafer demand status and forecast: continued rise In

Source: Prospective Industry Research Institute 's current global 12-inch wafer demand status and forecast: continued rise In terms of total demand, according to the statistics of global research institute SUMCO, the global 12-inch wafer market demand has been steadily increasing year by year, 2015 In the year, the year-on-year growth rates in 2016 and 2017 were 7.33%, 3.79% and 6.58%, respectively. Global demand in the first quarter of 2018 was approximately 5.8 million units/month, an increase of 7.4% from the same period last year.

Figure 3: Global 12-inch wafer demand scale 2015-2018  Source: Prospective Industry Research Institute

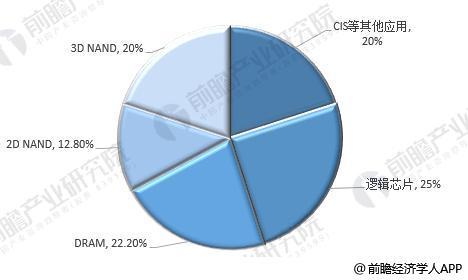

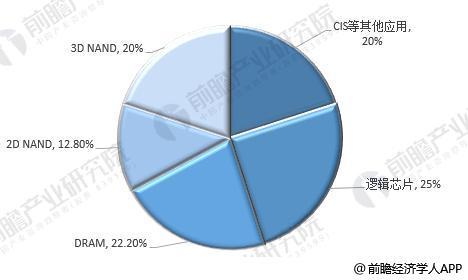

Source: Prospective Industry Research Institute According to SUMCO statistics, according to SUMCO statistics, 32.83% of 12-inch wafers will be used to produce NAND in 2018; 25% will be used to produce logic chips; and 22.2% will be used to produce DRAM. Among them, NAND Flash has 36% of the downstream market in the smart phone, so it can be judged that the capacity upgrade of the smart phone has increased the demand for 3D NAND, which has promoted the fab's demand for 12-inch silicon wafers.

Figure 4: Global 12-inch wafer demand distribution in 2018  Source: Prospective Industry Research Institute

Source: Prospective Industry Research Institute According to the proportion of shipment area of ​​various sizes of silicon wafers, 12-inch has become the mainstream in the industry. In 2017, it accounted for 66.1% of global wafer shipments. It is expected that by 2021, 12-inch silicon wafers will be produced. The shipment area will reach 71.2%.

Figure 5: Global 12-inch wafer demand scale 2015-2018  Source: Institute for Prospective status of the domestic industry collate semiconductor wafer supply: 12 inches mainly dependent on imports

Source: Institute for Prospective status of the domestic industry collate semiconductor wafer supply: 12 inches mainly dependent on imports to supply the market of China's semiconductor silicon view 12-inch silicon wafers mainly rely on imports, however, according to the Institute for forward-looking industry statistics At present, the planned production capacity of 12-inch wafers in China is about 1.2 million pieces/month.

Figure 6: Summary of China's 12-inch silicon wafers under construction capacity  Source: Prospective Industry Research Institute to sort out domestic 12-inch semiconductor wafer demand forecast: 2020, 80-100 million pieces / month,

Source: Prospective Industry Research Institute to sort out domestic 12-inch semiconductor wafer demand forecast: 2020, 80-100 million pieces / month, China's 12-inch silicon wafer demand is 450,000 pieces, with Jinghe integration, TSMC Nanjing Hege The core Chengdu has been put into production successively. With the completion of the three storage chip factories of Ziguang Nanjing, Changxin Hefei and Jinhua, it is estimated that the monthly demand for 12-inch silicon wafers in China will be 800-100 million pieces by 2020. Aside from the capacity of foreign fabs (Samsung Xi'an, SK Hynix Wuxi, Intel Dalian, Lianxin Xiamen, TSMC Nanjing, and G-Cheng Chengdu), the domestic monthly demand is about 400,000-500,000 pieces. At that time, the import dependence of domestic 12-inch wafers will decline.

Figure 7: Summary of capacity of China's under construction and planning 12-inch wafer fab  Source: Prospective Industry Research Institute

Source: Prospective Industry Research Institute Solar Street Light&Flood Light

Ningbo Wason Lighting Technology Co.,Ltd , https://www.nbwasonled.com

Source: Forward-looking Industrial Research Institute to organize the global silicon market competition status: 70% of the Big Three According to the Prospective Industry Research Institute's "2018-2023 Semiconductor Wafer, Epitaxial Film Industry Market Forecast and Investment Strategic Planning Analysis Report" According to the data, in the current global silicon market, Japan's Shin-Etsu, SUMCO, and Taiwan's Global Wafer have occupied 70% of the market share of silicon wafers, and the concentration is on the rise. Figure 2: Global wafer market pattern for 2016-2017

Source: Forward-looking Industrial Research Institute to organize the global silicon market competition status: 70% of the Big Three According to the Prospective Industry Research Institute's "2018-2023 Semiconductor Wafer, Epitaxial Film Industry Market Forecast and Investment Strategic Planning Analysis Report" According to the data, in the current global silicon market, Japan's Shin-Etsu, SUMCO, and Taiwan's Global Wafer have occupied 70% of the market share of silicon wafers, and the concentration is on the rise. Figure 2: Global wafer market pattern for 2016-2017  Source: Prospective Industry Research Institute 's current global 12-inch wafer demand status and forecast: continued rise In terms of total demand, according to the statistics of global research institute SUMCO, the global 12-inch wafer market demand has been steadily increasing year by year, 2015 In the year, the year-on-year growth rates in 2016 and 2017 were 7.33%, 3.79% and 6.58%, respectively. Global demand in the first quarter of 2018 was approximately 5.8 million units/month, an increase of 7.4% from the same period last year. Figure 3: Global 12-inch wafer demand scale 2015-2018

Source: Prospective Industry Research Institute 's current global 12-inch wafer demand status and forecast: continued rise In terms of total demand, according to the statistics of global research institute SUMCO, the global 12-inch wafer market demand has been steadily increasing year by year, 2015 In the year, the year-on-year growth rates in 2016 and 2017 were 7.33%, 3.79% and 6.58%, respectively. Global demand in the first quarter of 2018 was approximately 5.8 million units/month, an increase of 7.4% from the same period last year. Figure 3: Global 12-inch wafer demand scale 2015-2018  Source: Prospective Industry Research Institute According to SUMCO statistics, according to SUMCO statistics, 32.83% of 12-inch wafers will be used to produce NAND in 2018; 25% will be used to produce logic chips; and 22.2% will be used to produce DRAM. Among them, NAND Flash has 36% of the downstream market in the smart phone, so it can be judged that the capacity upgrade of the smart phone has increased the demand for 3D NAND, which has promoted the fab's demand for 12-inch silicon wafers. Figure 4: Global 12-inch wafer demand distribution in 2018

Source: Prospective Industry Research Institute According to SUMCO statistics, according to SUMCO statistics, 32.83% of 12-inch wafers will be used to produce NAND in 2018; 25% will be used to produce logic chips; and 22.2% will be used to produce DRAM. Among them, NAND Flash has 36% of the downstream market in the smart phone, so it can be judged that the capacity upgrade of the smart phone has increased the demand for 3D NAND, which has promoted the fab's demand for 12-inch silicon wafers. Figure 4: Global 12-inch wafer demand distribution in 2018  Source: Prospective Industry Research Institute According to the proportion of shipment area of ​​various sizes of silicon wafers, 12-inch has become the mainstream in the industry. In 2017, it accounted for 66.1% of global wafer shipments. It is expected that by 2021, 12-inch silicon wafers will be produced. The shipment area will reach 71.2%. Figure 5: Global 12-inch wafer demand scale 2015-2018

Source: Prospective Industry Research Institute According to the proportion of shipment area of ​​various sizes of silicon wafers, 12-inch has become the mainstream in the industry. In 2017, it accounted for 66.1% of global wafer shipments. It is expected that by 2021, 12-inch silicon wafers will be produced. The shipment area will reach 71.2%. Figure 5: Global 12-inch wafer demand scale 2015-2018  Source: Institute for Prospective status of the domestic industry collate semiconductor wafer supply: 12 inches mainly dependent on imports to supply the market of China's semiconductor silicon view 12-inch silicon wafers mainly rely on imports, however, according to the Institute for forward-looking industry statistics At present, the planned production capacity of 12-inch wafers in China is about 1.2 million pieces/month. Figure 6: Summary of China's 12-inch silicon wafers under construction capacity

Source: Institute for Prospective status of the domestic industry collate semiconductor wafer supply: 12 inches mainly dependent on imports to supply the market of China's semiconductor silicon view 12-inch silicon wafers mainly rely on imports, however, according to the Institute for forward-looking industry statistics At present, the planned production capacity of 12-inch wafers in China is about 1.2 million pieces/month. Figure 6: Summary of China's 12-inch silicon wafers under construction capacity  Source: Prospective Industry Research Institute to sort out domestic 12-inch semiconductor wafer demand forecast: 2020, 80-100 million pieces / month, China's 12-inch silicon wafer demand is 450,000 pieces, with Jinghe integration, TSMC Nanjing Hege The core Chengdu has been put into production successively. With the completion of the three storage chip factories of Ziguang Nanjing, Changxin Hefei and Jinhua, it is estimated that the monthly demand for 12-inch silicon wafers in China will be 800-100 million pieces by 2020. Aside from the capacity of foreign fabs (Samsung Xi'an, SK Hynix Wuxi, Intel Dalian, Lianxin Xiamen, TSMC Nanjing, and G-Cheng Chengdu), the domestic monthly demand is about 400,000-500,000 pieces. At that time, the import dependence of domestic 12-inch wafers will decline. Figure 7: Summary of capacity of China's under construction and planning 12-inch wafer fab

Source: Prospective Industry Research Institute to sort out domestic 12-inch semiconductor wafer demand forecast: 2020, 80-100 million pieces / month, China's 12-inch silicon wafer demand is 450,000 pieces, with Jinghe integration, TSMC Nanjing Hege The core Chengdu has been put into production successively. With the completion of the three storage chip factories of Ziguang Nanjing, Changxin Hefei and Jinhua, it is estimated that the monthly demand for 12-inch silicon wafers in China will be 800-100 million pieces by 2020. Aside from the capacity of foreign fabs (Samsung Xi'an, SK Hynix Wuxi, Intel Dalian, Lianxin Xiamen, TSMC Nanjing, and G-Cheng Chengdu), the domestic monthly demand is about 400,000-500,000 pieces. At that time, the import dependence of domestic 12-inch wafers will decline. Figure 7: Summary of capacity of China's under construction and planning 12-inch wafer fab  Source: Prospective Industry Research Institute

Source: Prospective Industry Research Institute