Daily Comment: Macro Expectations Worried to Increase Steel Prices and Continue to Go Down

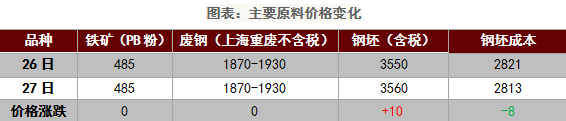

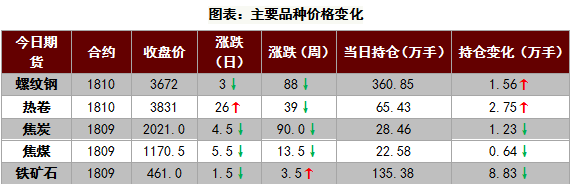

Today's point of view Today, the main domestic steel prices have been lower, the volume of trading is obviously constrained, and the mentality is also in a trough. On the one hand, the current supply is in a slow recovery phase after environmental protection, and crude steel production has also remained high; on the other hand, the traditional off-season comes, no matter how the final impact of the high temperature plum rain in the south, the general lightness of the transaction greatly increases market pressure. As well as the continuous evolution of the recent trade war, the state's liquidity of liquidity has not played a substantial role. The middle and lower reaches of the market are on the verge of high-cost pressure, leaving only the unilateral support of the ex-factory price of steel mills. In summary, it is expected that the steel market price is still difficult to get rid of the shock and run downwards. It is recommended to operate cautiously and reasonably. Macro hotspot 1. [Crude oil futures closed higher, agricultural products rose in the lead] crude oil closed up 3.6%, beans increased 3%, soybean meal, rapeseed meal, asphalt rose more than 2%, Shanghai lead, Shanghai zinc, soybean oil, plastic, Zheng alcohol, Rapeseed and palm rose more than 1%, Zhengyou, Shanghai Aluminum, Ferrosilicon, Bean, Rubber, PVC, Hot Roll, Corn, Apple, White Sugar, Shanghai Gold, Shanghai Tin, etc. closed up. Coke, coking coal, Shanghai nickel, Zheng coal, thread, iron ore, manganese silicon, Shanghai copper, Zheng cotton, cotton yarn, glass, eggs, etc. closed down. 2, [the afternoon Shanghai stock index lost 2800 points, the power of the major declines, the new stocks rose strongly] The Shanghai Composite Index closed at 2,128.87 points, down 1.10%, with a turnover of 142.4 billion. The Shenzhen Component Index closed at 9186.66 points, down 1.83%, with a turnover of 183.8 billion. The GEM closed at 1546.23 points, down 1.19%, with a turnover of 63 billion. 3. [Onshore and offshore RMB both fell below the 6.6 mark] On the shore, the RMB fell below the 6.6 mark against the US dollar and fell by 200 points during the day. Offshore RMB fell below the 6.6 mark against the US dollar, falling 200 points in the day, hitting a new low since December 20, 2017. Offshore renminbi fell for 10 days and tied the losing streak. 4. [Speaking spokesperson of the Ministry of Commerce of the People's Republic of China on the proposed restrictions on investment restrictions in the United States] In response to the proposed US investment restrictions, the Ministry of Commerce spokesperson answered questions from the media on the 27th. The spokesman said that we noticed The US news about the proposed investment restrictions is being closely watched and will assess the potential impact on Chinese companies. Market today Raw material Billet: The price of the national billet market has risen and fallen. Today, Tangshan steel billet rose 10 yuan / ton, Shandong, Shanxi steel billet dropped 30 yuan / ton, Jiangsu fell 20 yuan / ton. Today, Tangshan billet straight transactions in general, warehousing spot 3640 or so tax-included out of the warehouse, high-priced transactions are difficult; period snail shock operation, businesses more wait and see, the finished products of some varieties of volume, the price rose slightly. Today, Shandong steel billet is reduced by 30 yuan / ton, Q235 billet factory is 3,620 yuan / ton, steel mills can take orders, billets are sent to the south, and there are many inquiries downstream. Intermediaries are cautiously watching. Domestic mines: Some market prices of domestically produced main producing areas fell slightly. Guangxi Liuzhou price fell 10 yuan / ton. Specifically, the North China-Tangshan 66% dry-based tax-included cash factory is 635-645 yuan / ton, the west of the 66% dry-based tax-included cash out of 620-630 yuan / ton, Qian'an 66% dry basis tax-included cash factory 645-655 yuan / ton; Zunhua 66% dry basis tax-included cash factory 630-640 yuan / ton. Imported mines: Early import traders were optimistic about the offer, and some varieties were down by 5 yuan/ton from yesterday. The mainstream price of PB powder in Shandong area is 455 yuan/ton, and the mainstream price of PB powder in Tangshan area is 460 yuan/ton. In the morning, the market was relatively quiet, and the steel mills were mostly inquiries; in the afternoon, the market still had no improvement, the steel mills had lower prices, and the traders were not willing to accept them. As of press time, the transaction was slightly deserted. Steel spot Construction steel: Today's domestic construction steel prices are steadily decreasing. In terms of specific prices, the average price of 25 major cities nationwide was 4,116 yuan / ton, down 14 yuan / ton from the previous trading day. In addition to the small rebound in Jinan and Tianjin, prices in North China, South China, Northeast China and Southwest China continued to fall. Prices in Central China and Northwest China remained stable. The overall market turnover in today's market has improved compared with yesterday. However, due to the fluctuation of the snail width, the snail rebounded slightly in the early trading period, and the market transaction was still acceptable. After the snail diving in the late afternoon, the spot market inquiry was ruined and the transaction was scarce. On the whole, the market demand is not good, coupled with the tight capital in the middle of the year, the traders are willing to ship, so it is expected that the domestic building materials prices will be adjusted to operate weakly tomorrow. Hot-rolled coil: Today, the hot rolling price of 24 major cities in the country is consolidating. The average price of 3.0 hot-rolled coils is 4322 yuan/ton, which is 8 yuan/ton lower than the previous trading day. The average national price of 4.75 hot-rolled coils is 4265. Yuan/ton, down 7 yuan/ton from the previous trading day. Today's futures market fluctuated and the market sentiment improved. However, the overall demand is still weak, the transaction has not improved significantly, and the market prices have risen and fallen. In the short term, market demand is unlikely to improve significantly, lack of support for transactions, and price increases are weak. In addition, today's billet market price rose by 10 yuan / ton, the current price of carbon billet is 3560 yuan / ton. On the whole, it is expected that the price of the hot-rolled market will fluctuate tomorrow. Plate: Today's domestic plate market price is weak, and the average price of 20mm plate in 23 major cities nationwide is 4,400 yuan / ton, down 7 yuan / ton from the previous trading day. Although the night market futures market rebounded yesterday, the downward trend of today's trading period is still difficult to boost the market. In addition, the general market feedback in the near-term period is not smooth, so the traders' cash-selling sentiment increases. On the other hand, the recent trading of spot resources has been blocked, and the subsequent stage is about to enter the low season of demand. Therefore, it is expected that the price of the domestic plate market in the short-term will continue to weaken. Cold rolled coil: Today's national cold rolling prices fell slightly. Price: 1.0 national cold rolling average price of 4,715 yuan / ton, compared with the previous working day price fell 6 yuan / ton. The main market price: Shanghai market 1.0mm WISCO coil plate offer 4670 yuan / ton, Guangzhou market 1.0mm anang steel coil offer 4700 yuan / ton, Tianjin market 1.0mm anang steel coil offer 4540 yuan / ton. Market: Today's price continues to decline, with a decline of 10-30 yuan / ton, but last night's futures continued to strengthen, business confidence has stabilized, business quotes firm, but high turnover is not smooth. As far as the current request is concerned, the demand has not recovered. It is expected that the cold rolling price will fluctuate within a narrow range tomorrow. Steel: Today's domestic steel prices have fallen slightly. The average price of Gongjiao and H-beams has dropped by 10-20 yuan/ton from yesterday. Specifically, Tangshan profiles fell 10-20 yuan / ton in the morning, the overall transaction volume after the fall, the market trading atmosphere is active, the business heart slightly improved, have taken the opportunity to take the opportunity to ship. In the afternoon, the price was steady, and some merchants were looking for more shipments. The intraday price was loose, but the overall transaction in the afternoon was weak compared to the morning. The price of East China profiles was weakly consolidating, and the price of H-beams was generally stable, and the price of Gongzi slots fell slightly by RMB 10-20/ton. After the recent spot decline, the transaction was general, but the market feedback of the previous steel mill orders arrived one after another, and resources began to be under pressure. South China's profile business offers more stable prices, but the mainstream has a tendency to move closer to the low. Although the Tangshan market has rebounded in the morning, the South China market is not well-sold, the business mentality is cautious, and near the end of the month, the funds are tight, and the downstream demand is unlikely to improve in a short period of time. On the whole, although the price decline has little effect on the transaction stimulus, but the overall atmosphere is negative and the steel company guides the price to loosen the price or maintain the consolidation and weakening operation. Steel pipe: Domestic pipe prices fell slightly today. In terms of varieties, the average price of welded pipe 4 inch *3.75mm is 4361 yuan / ton, down 1 yuan / ton from the previous trading day; galvanized pipe 4 inch * 3.75mm national average price 5071 yuan / ton, compared with the previous transaction The daily drop was 18 yuan / ton; the average price of seamless pipe 108 * 4.5mm was 5264 yuan / ton, up 1 yuan / ton from the previous trading day. Regarding the pipe factory, the prices of Tianjin Youfa, Juncheng and Lida were not adjusted. The hot rolling price of Linyi mainstream seamless pipe factory was 4,850 yuan/ton. In terms of welded pipes and galvanized pipes, the overall market transactions were general, and the pressure on pipe manufacturers was relatively high. Various preferential policies were introduced, and the cost of arrival of traders was reduced. In terms of seamless pipes, market transactions are still general, traders still rely on the consumption of old stocks, and the market bearish sentiment is strong. It is expected that the market price of steel pipe will continue to fluctuate and run weaker tomorrow. Futures: Today, the domestic black commodity futures rallied, the volume of transactions shrank, and the funds flowed out slightly. Among them, except for the hot volume, the other varieties closed down slightly. Specifically: the performance of the spot market is still weak today, the transaction is general, the intraday futures market rebounds, the market willingness to get goods becomes stronger, and the transaction is slightly improved, but as the price rises, the high-priced resources are difficult to trade, and the spot market is weak. Taking the snail as an example, the daily line closed up on the Yangxian line, and the rebound on the 5-day line was blocked, and the trend was down. The above suggestions, the rallies short, the main position. Moving Head Light,Led Wash Moving Head Light,Moving Head Mini Led Spot Light,Moving Head Beam Lights EV LIGHT Guangzhou Co., Ltd , https://www.evlightprofessional.com